Sep. 27, 2022

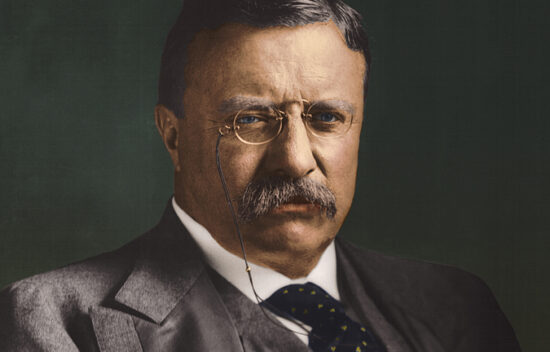

In my opinion, one of the greatest presidential speeches (and motivational speeches as well) in...

Sep. 22, 2022

Over the past number of years, you have heard a lot of "experts" say "Follow...

Sep. 15, 2022

In my previous post, I focused on some of the significant challenges that face organizations...

Sep. 07, 2022

I spend a lot of time speaking with Higher Education clients and potential clients in...